My main business strategy involves purchasing businesses within the $200-400k SDE range, and then expanding them to become a $1M+ EBITDA business. To clarify, I buy businesses at 1-2x and sell them at 4-5x. For example, I might purchase a business with $300k SDE for $600k and sell it 2-5 years later at $1M EBITDA for $4-5M. We aim to acquire one business per quarter using this method.

It’s worth noting that I refer to SDE and EBITDA. Smaller businesses are often valued based on a multiple of SDE because the owner is typically involved day-to-day and there is no formal management structure. On the other hand, EBITDA tends to be used for larger, investor-style businesses with an established management team in place. It’s important to recognize this distinction as it can impact the sale price of the business.

However, many businesses struggle to surpass the $1M-$2M gross sales point as it becomes increasingly challenging for one person to manage. Owners may find themselves working 50-60 hours a week, or hiring an operator to manage the day-to-day operations. Crossing this threshold typically requires a different management structure.

To illustrate this point, let’s consider a plumbing company with $2M in gross sales and $300k in SDE. Currently, they likely have 4-6 trucks, someone in the office handling administrative tasks, and an owner/operator who oversees everything else, including taking on plumbing jobs themselves. In contrast, a $1M+ EBITDA company would have around 10-15 trucks, an operator, a middle manager, several senior technicians, and several regular technicians. With the right management structure, this type of company can be run remotely, with the owner only needing to interact with the operator.

The smaller organization operates with a flat structure, whereas larger organizations are structured like pyramids. Almost all $1M+ EBITDA companies have some form of organizational structure, making it crucial to focus on creating an ideal structure for your company. This can be achieved by studying companies in your industry that are of a similar size.

It’s important to note that the goal is not to become a business owner, but an investor in businesses. At the beginning, you may need to be more hands-on, but with the right approach, you should eventually be able to step back and invest in as many businesses as you desire. To become an investor, you need to know your Key Performance Indicators (KPIs). Examples of KPIs include cash on hand, monthly revenue, sales pipeline, and expenses over time. It’s ideal to have KPIs managed overseas to obtain a clear and current snapshot of your business in under 30 seconds.

To grow from $300k to $1M, the process involves hiring management. The first step is to find an operator. Typically, ex-military officers are hired for this position, with 2-5 in training at any given time. Trainees work directly under an exemplary operator, learning all aspects of the business. Ex-military personnel are willing to relocate to where the next business has been purchased, making them ideal candidates. The training process lasts from 3-12 months, with the goal of having the operator ready to run the business by day one. Weekly calls and a fully paid company trip once a year help operators mastermind and stay motivated. Operators are paid salary, bonuses, and receive additional bonuses at the time of sale. This approach has been successful in producing great results and high profits.

I typically seek out businesses that haven’t embraced modern marketing techniques. Therefore, we use my marketing business, which offers paid advertising, search engine optimization, local SEO (including Google Guaranteed, local Google Ads, GMB optimization, and reputation management). Implementing these services can typically increase lead flow by 3-10 times. You can find plenty of courses on how to apply these methods effectively.

For Example:

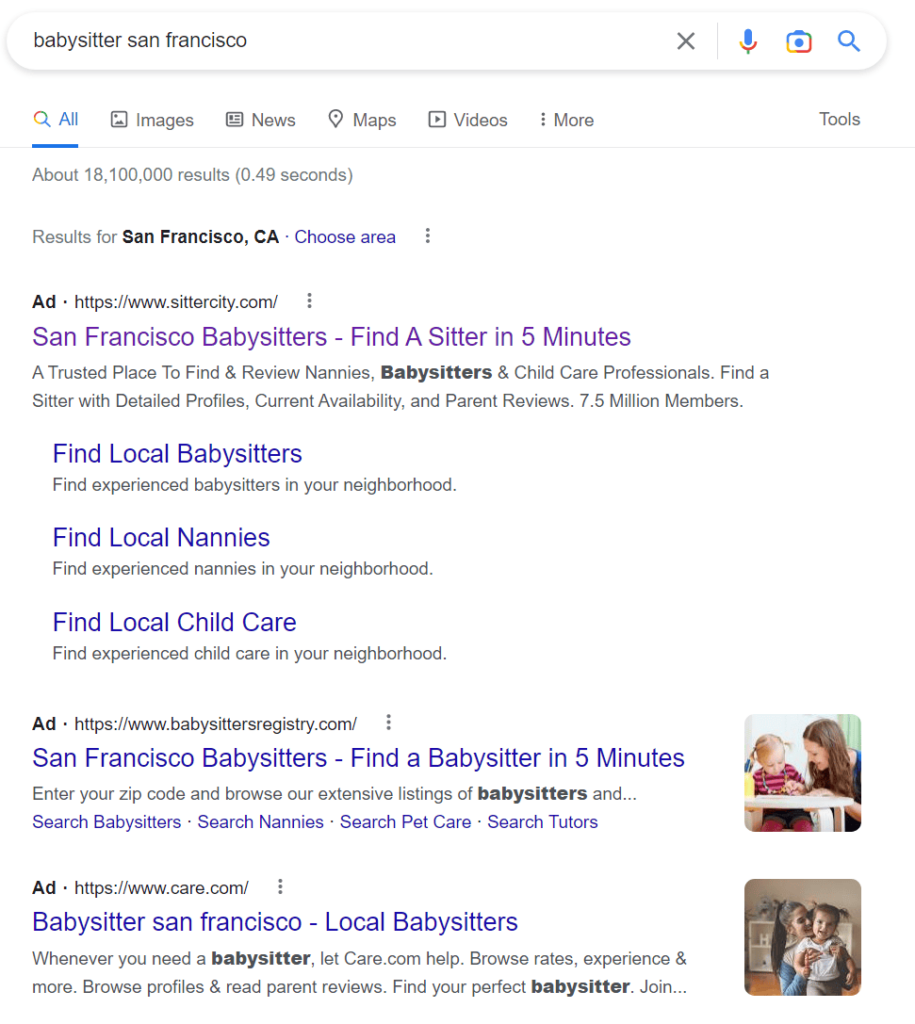

Let’s do “babysitting in San Francisco” for example.

What does a person who needs a babysitter do?

They would type in “babysitting in San Francisco”

Here’s what I see:

– Top three places are taken by “Uber for X.” Typically, these companies are burning tons of money on PPC, so I would not be able to compete here.

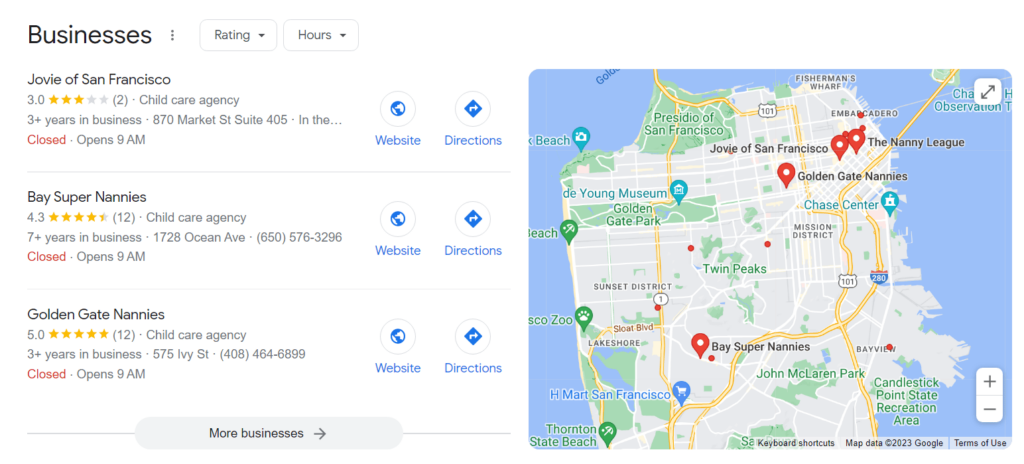

– GMB: definitely there’s an opportunity there.

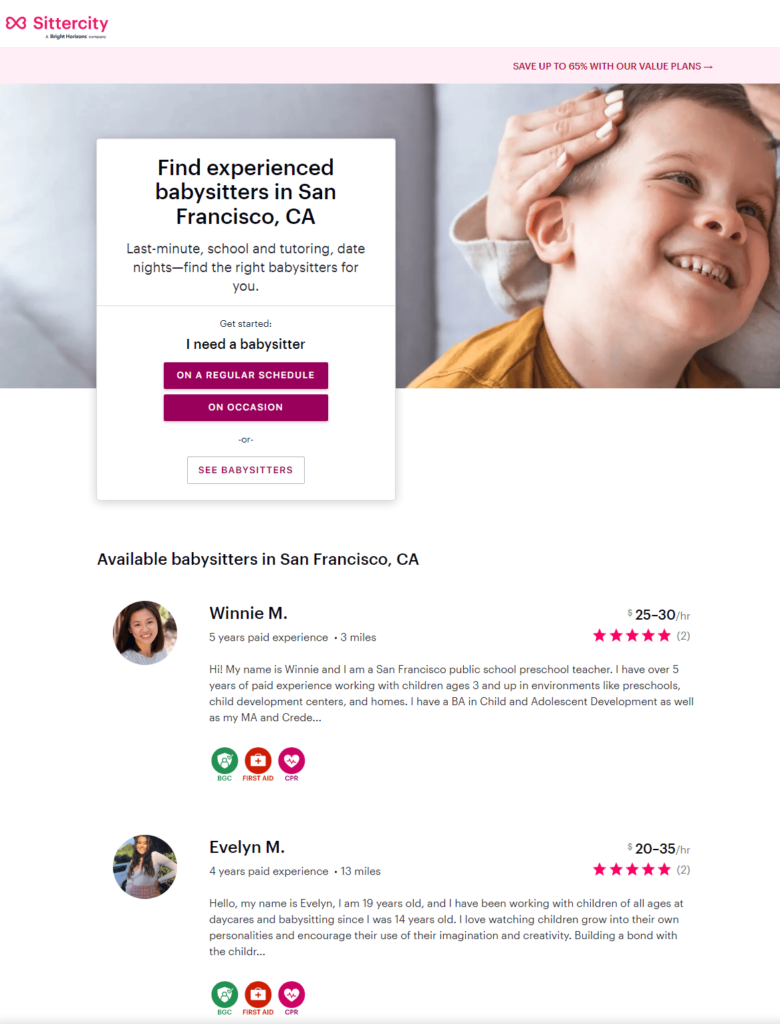

SEO: there’s always a opportunity in long tail, but short-tail is probably not likely here: same Uber for X learned how to optimize their websites quite well:

Sales process: Uber for X has it done pretty well. They immediately try to go for continuity with “do you want a babysitter regularly?” and then they have a ton of babysitters on their platform. If I am tiny, I’d better make sure I can meet demand when I start generating more leads.

We also scrutinize the sales process, assessing how sales are handled and identifying how it differs from industry best practices. In many cases, the sales process is substandard. It lacks follow-up or follow-through, and nobody seems to care about it. We apply industry best practices and train the staff accordingly. I believe that all businesses are sales businesses, PERIOD.

We also integrate new software into our businesses. For instance, we use Service Titan for many of our businesses, but we’ve also tested Jobber and Workiz. Furthermore, we use GoHighLevel to manage all leads. Quickbooks online is also utilized. Each business has its own budget for software, and we don’t share even when it’s possible.

All incoming calls are handled from a central location, so that calls, follow-ups, and lead management are all centralized and managed. We use GHL to filter and then import leads into a CRM, usually Dynamics (although we’re experimenting with Monday). All calls are recorded and reviewed weekly. Most of the calls are handled overseas and can be transferred to the location if necessary. The business pays for the call center’s services. This procedure is documented for each company, enabling us to have all customer contact processes documented and easily reproducible. When we sell the business, the call center is typically kept overseas, but we can easily transfer it back to the company onshore. It’s much more cost-effective and more efficient than having Bertha in the office barely answering the phones.

We aim to reactivate databases for all businesses on a regular basis, and have experimented to determine the optimal frequency and offers that increase response rates. This tactic usually contributes to at least 10% of yearly sales.

Business Incentives

Our companies operate with strong incentives for employees. For example, our phone personnel receive bonuses based on the rate at which they book calls. We expect a minimum of 20% of calls to be booked, and if this is not met, we put them on probation and provide coaching on how to improve. Payment rates range from a base of $4/hr for phone help to over $20/hr for our best employees in the Philippines, significantly higher than other companies in the area. We also incentivize technicians to upsell services and receive a $20 bonus for each 5-star review on Google. Management is incentivized based on meeting their KPIs, and we aim to incentivize everyone to work towards the common goal of profit and a well-run company.

With effective management, increased leads, improved tech, and handling of bookings and incoming calls, we turn our attention to the business itself. We know the industry averages for profitability and aim to exceed these benchmarks. If the industry average is 15% profitability, but we know we can reach 20%, we will adjust pricing and potentially reduce internal staff costs. Since we outsource much of our work overseas, including bookkeeping, call answering, and billing, we can significantly reduce fixed costs. We may also move to a smaller location or sublet previously used space.

Next, we will explore ways to increase sales within the company. We start by examining what our ideal customer wants but we don’t already provide. We approach this from two perspectives: what we can offer that we don’t currently offer, and where we can offer it that we haven’t previously. For instance, a kitchen and bath remodeling company could expand to offer garage renovations or home organization build-outs, resulting in a 2-3x increase in sales.

Summary

In summary, we have accomplished the following:

-

- Enhanced the management structure

- Boosted lead generation by 2-10x

- Streamlined sales processes through GHL and follow-ups

- Upgraded company technology

- Reduced costs by outsourcing several functions overseas

- Increased profitability by raising prices and cutting costs

- Motivated our staff by implementing incentives

- Expanded sales 2-3x by offering more services in more locations.

All these efforts align with the Jay Abraham Power Parthenon, which states that there are only three ways to grow a business: increase the number of clients, boost the average sale per client, and increase the frequency of repurchase. Looking at our list of eight accomplishments, they fit into the Power Parthenon as follows:

- (# of clients) – 2, 3, 7, 8

- (Avg sale) – 3, 6, 7

- (frequency) – 3, 8

It’s essential to keep the Power Parthenon in mind and consider regularly reading “Built to Sell” and “Buy then Build.” This is a high-level overview, but it demonstrates what happens when you buy a company and how you can transition from a one-person SDE-based business to a modern EBITDA-based business. Having a plan for progressing from one stage to the next is crucial. There’s enormous potential for profit in each valuation tier, so happy hunting and good luck!